4/15/25 update: As you’ve likely heard, there’s been movement on this already. On April 9, President Trump announced a 90-day pause on new tariffs for most countries except Chinese imports, which have increased to a 145% tariff rate. The explainer below can still help you get a sense of what’s going on.

Tariffs are the top story everywhere, and the optical industry is not immune. Uncertainties about the practical impact of the tariffs abound, so let’s break down what’s going on:

President Trump announced “reciprocal” tariffs on April 2, 2025, slapping a 10% blanket duty on nearly all imports, with certain countries, like China, facing even steeper increases.

Reciprocal tariffs means that if a country has higher tariffs than we do on certain products, we’ll raise ours to that level. That’s not exactly what’s happening, as a truly reciprocal situation would require a very complex administrative review of tariff codes and products. But it’s still early days.

What’s the overall takeaway at this time? As The Vision Council notes:

In the short term, increased import costs are likely to be passed along to consumers. However, there is potential for diplomatic negotiations to reduce or exempt certain tariffs, and other countries are expected to issue retaliatory tariffs, like China announced [on April 4], with a matching 34% tariff on imports from the United States. Industry efforts to diversify production across various countries in light of previous country-specific tariffs may need to be re-evaluated considering this new trade environment. (Source: The Vision Council Addresses New Reciprocal Tariffs and Their Impact on the Optical Industry)

Optical goods among most affected

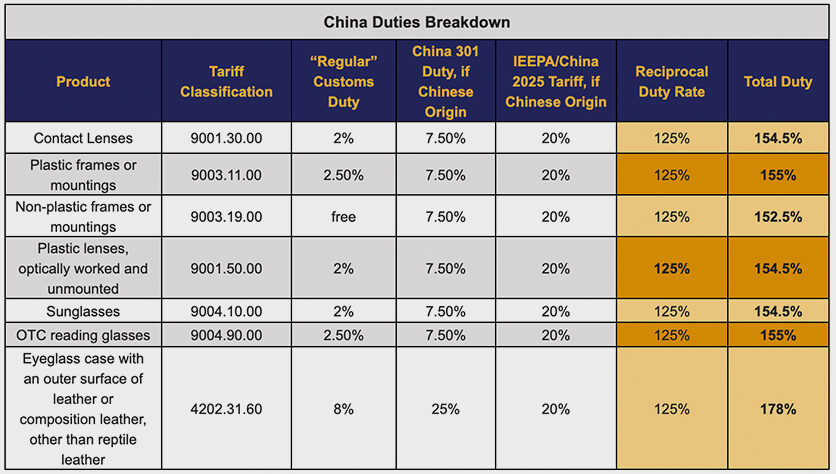

The newly announced tariffs will stack on top of existing duties rather than replacing them. Here’s an example that illustrates the steep climb: Plastic eyeglass frames from China, a common product category, now carry a combined duty rate of approximately 64%. That includes:

- 2.5% standard duty

- 7.5% China Section 301 tariff

- 20% IEEPA duty

- 34% reciprocal duty

Over-the-counter readers, sunglasses, safety glasses, and goggles imported from China are also impacted. Eyeglass cases and some lens processing may face duty rates between 80 and 90%.

Broadly, we’ll need to keep an eye on retaliatory tariffs. [4/9/25 update: China just responded by increasing its retaliatory tariffs to 84% on U.S. goods.] The situation is very much developing.

4/15/25 update:

What ODs should watch

According to The Vision Council, in addition to cost increases, you’ll want to pay attention to compliance rules, especially around country of origin declarations. Goods that enter the U.S. after enforcement dates are subject to the full tariff rate, even if they were in transit prior.

The determination of origin is also a factor. Origin follows the principle of “substantial transformation.” That means if components are made in one country but significantly altered in another (changing their name, character, or use), the second country may be considered the origin. Mislabeling or misunderstanding this process can carry stiff legal penalties.

Growing concerns among ECPs

Surveys conducted by Jobson Research reveal escalating apprehension among ECPs regarding the financial implications of the new tariffs. In March, 76% of respondents expressed being very or somewhat concerned about the impact on the cost of goods, an increase from 70% in February. Additionally, 73% were worried about the effect on their bottom line, up from 66% the previous month.

For now, practices are responding in various ways:

- Some are considering passing increased costs onto patients, with 42% indicating they would transfer 100% of the additional expenses.

- Others are exploring adjustments to their product portfolios, with 47% contemplating changes based on manufacturing origin.

What you can do

Supplier strategy now needs to be under closer review. Initiate conversations with your vendors to gain clarity on sourcing and pricing. You might look at diversifying your supply chain, adding vendors based in lower-tariffed countries or working more closely with domestic partners. If that’s not an option, think about consolidating orders to negotiate better volume discounts and reduce shipping frequency.

You probably shouldn’t make sweeping changes to pricing just yet, but explore the impact of small, targeted adjustments, keeping in mind that you’ll need to be prepared to explain potential price increases to patients and offer advice on cost-effective solutions.

Inventory management is another area to reconsider. You want to reduce overexposure to volatile categories while keeping your key products in steady supply. Look at your data to guide future purchasing decisions more closely.

And it almost goes without saying, but staying informed is non-negotiable. Our Optometry 411 newsletter will continue to bring you the latest updates and developments — and with so much still unknown, we can expect developments. Crucially, advocacy is underway. The Vision Council’s Government Relations team is in discussions with congressional leaders and key committees that influence the United States Trade Representative to push for the creation of an exemption process that would allow affected U.S. companies to formally petition for relief.

Recommended viewing: The Vision Council’s Omar Elkhatib and Rick Van Arnam Talk With VM About the Impact of Tariffs

Note: The Vision Council recently hosted an informational webinar and has a variety of resources available here for members to stay informed as the situation evolves. A recording of the webinar is available upon request by emailing media@thevisioncouncil.org.

4/15/25 update: A second webinar from The Vision Council will take place 4/16/25 at 1 p.m. CT.